Read about the six best practices now required by Financial Controllers to overcome their challenges. Financial Controllers have traditionally been mainly associated with number crunching. However, modern business competition required Financial Controllers to be more than just the number cruncher and become their CFO’s “right-hand” person to ensure efficiency in the Finance function. Ensuring operational efficiency is not an easy task. It requires an understanding of best practices around:

- Improving productivity;

- reducing costs; and,

- streamlining processes.

In other words, modern business challenges have created more responsibility for Financial Controllers. However, unfortunately, increased responsibilities are not always backed by additional resources. Instead, Controllers often have to do more with less. Their challenge is generating accurate data to make informed business decisions.

However, on a positive note, most top Controllers worldwide have successfully met those challenges by following these six Financial Controller best practices:

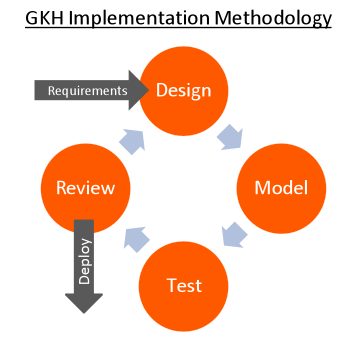

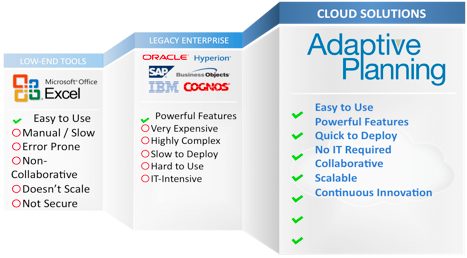

- Automate the planning and reporting process

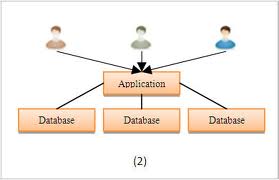

- Streamline data to increase productivity

- Turn data into insight

- Pursue a self-service culture

- Unify your planning, consolidation, and analytics process

- Create collaboration

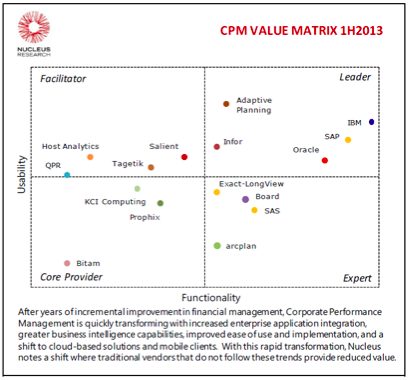

Click here to read about these six top Financial Controller best practices from Workday Adaptive Planning’s eBook.

Go beyond number crunching. Be a strategic decision-maker that adds value.